FOMC Minutes: Gold Prices Holding Steady As The Fed Sees Signs Of A Very Strong Economy

Friday, July 6, 2018 12:50:14 PM Europe/Tallinn

Gold prices continue to hold on to its gains even after the minutes from the June Federal Reserve monetary policy meeting showed overall optimism on the U.S. economy.

According to the June minutes, participants saw the U.S. economy has "very strong" with inflation rising to 2% over the medium term. In this environment, the committee saw interest rates rising to slightly above their long-term estimates within the next two years.

Despite the positive comments, gold prices remain unfazed holding on to modest gains. August gold futures last traded at $1,257.30 an ounce, up 0.30% on the day.

"Participants noted a number of favorable economic factors that were supporting above-trend GDP growth; these included a strong labor market, stimulative federal tax and spending policies, accommodative financial conditions, and continued high levels of household and business confidence," the minutes said.

However, even with the overall positive tone of the minutes, the committee also saw storm clouds looming over the horizon. In particular, the committee saw growing uncertainty as a result of current trade policies.

"Most participants noted that uncertainty and risks associated with trade policy had intensified and were concerned that such uncertainty and risks eventually could have negative effects on business sentiment and investment spending," the minutes said.

The committee also saw growing risk of a recession.

"Some participants raised the concern that a prolonged period in which the economy operated beyond potential could give rise to heightened inflationary pressures or to financial imbalances that could lead eventually to a significant economic downturn," the minutes said.

Sources: Kitco.com / Neils Christensen

Gold, Silver Sink As U.S. Dollar Resumes Rally

Thursday, April 26, 2018 1:50:00 PM Europe/Tallinn

Gold and silver prices are lower in early-afternoon U.S. trading Wednesday. Gold dropped to a four-week low today. The precious metals were pressured in part by a resumption of the appreciation of the U.S. dollar on the foreign exchange market. The U.S. dollar index hit a 3.5-month high today. The USDX has also seen a bullish upside technical breakout on the daily chart, to suggest more gains in the near term. Such could be a significantly bearish weight on the metals in the coming weeks. The safe-haven metal bulls need a big dose of geopolitical uncertainty to jumpstart price rallies. June Comex gold futures were last down $9.30 an ounce at $1,323.80. May Comex silver was last down $0.183 at $16.52 an ounce.

World stock markets were mostly lower overnight. U.S. stock indexes are weaker in afternoon New York dealings. Investor risk appetite has waned a bit at mid-week on some disappointing corporate earnings reports and worries about rising interest rates and inflation. If the U.S. stock market sells off sharply in the near term, look for gold to see safe-haven demand surface.

A feature in the marketplace recently has been rising world government bond yields. The U.S. Treasury 10-year note yield on Tuesday moved above 3.0%--the highest level in four years. U.S. bond yields rose further Wednesday.

The other key “outside markets” on Wednesday sees Nymex crude oil prices near steady and trading just below $68.00 a barrel. The oil market has been supported recently by stronger world economic growth and on some notions that the U.S. could pull out of a deal struck with Iran regarding its nuclear ambitions. If the U.S. slaps sanctions on Iran again, that would reduce Iran’s capacity to sell oil on the world market.

The silver bulls and bears are on a level overall near-term technical playing field. Silver bulls' next upside price breakout objective is closing prices above solid technical resistance at the April high of $17.36 an ounce. The next downside price breakout objective for the bears is closing prices below solid support at the March low of $16.10. First resistance is seen at today’s high of $16.71 and then at $16.89. Next support is seen at today’s low of $16.475 and then at $16.25.

sources: Kitco,

Bad News Is Still Good News For Gold

Tuesday, April 10, 2018 2:39:36 PM Europe/Tallinn

Gold prices rose on Friday and U.S. equities sold off on trade-related concerns. Meanwhile the dollar was lower while Treasury prices were higher as safe-haven buying was in evidence. Gold continues to benefit from economic uncertainty and broad equity market weakness which remain the two main drivers of its recent buoyancy. As we'll examine in this commentary, the technical odds are still in favor of gold feeding off these factors and strengthening in the near term.

Spot gold rose 0.5 percent at $1,332 on Friday while June gold futures settled 0.6 percent higher at $1,336. This allowed the gold price to finish a somewhat tumultuous week above its key immediate-term trend line and comfortably above its 3-month trading range floor.

One of the news-related factors which helped boost gold prices on Friday was the latest U.S. payrolls data. While the unemployment rate held steady at 4.1% for the sixth straight month there were signs that the pace of hiring slackened in March, according to the latest numbers from the Labor Department. Payrolls rose to 103,000 in March, which was well below the consensus forecast by economists. This represented the lowest level of job creation in six months, which prompted worries among traders that the Federal Reserve might be forced to slow the pace of its interest rate increases. This helped buoy the gold price, but the main catalyst for the metal’s latest rise was the sell-off in stock prices.

As has been a lingering problem for Wall Street, the latest rhetoric from the Trump administration and Chinese officials over trade tariffs upset the equity market, causing the Dow Jones Industrial Average to plunge 572 points, or 2.34%. President Trump late last week threatened to impose an additional $100 billion in tariffs on Chinese imports while Beijing pledged a “fierce counter strike.”

Sources: Seeking Alpha

Best Bullion is a member of the Estonian Chamber of Commerce and Industry since November 2016

Monday, March 12, 2018 4:20:53 PM Europe/Tallinn

The Estonian Chamber of Commerce and Industry (ECCI) is the oldest and largest Estonian representative organization of entrepreneurs and was founded to represent and protect common interests of Estonian merchants, manufacturers, bankers and ship-owners in the year 1925. Today, the ECCI with almost 3,200 members is the largest business representation organization in the country.

The mission of the ECCI is to develop entrepreneurship in Estonia through business services and playing an active role in designing economic policy.

Silver Coins Estonia - Buy with confidence!

Best Bullion Team.

Silver Hit by Heaviest Bearish Betting in 15 Years, Gold Prices Unmoved by Italy's 'Messy' Election

Sunday, March 11, 2018 2:06:26 PM Europe/Tallinn

Sources: Kitco , Bullion vault.com

Gold, Silver Prices Down On Higher U.S. Dollar

Wednesday, February 21, 2018 3:07:43 PM Europe/Tallinn

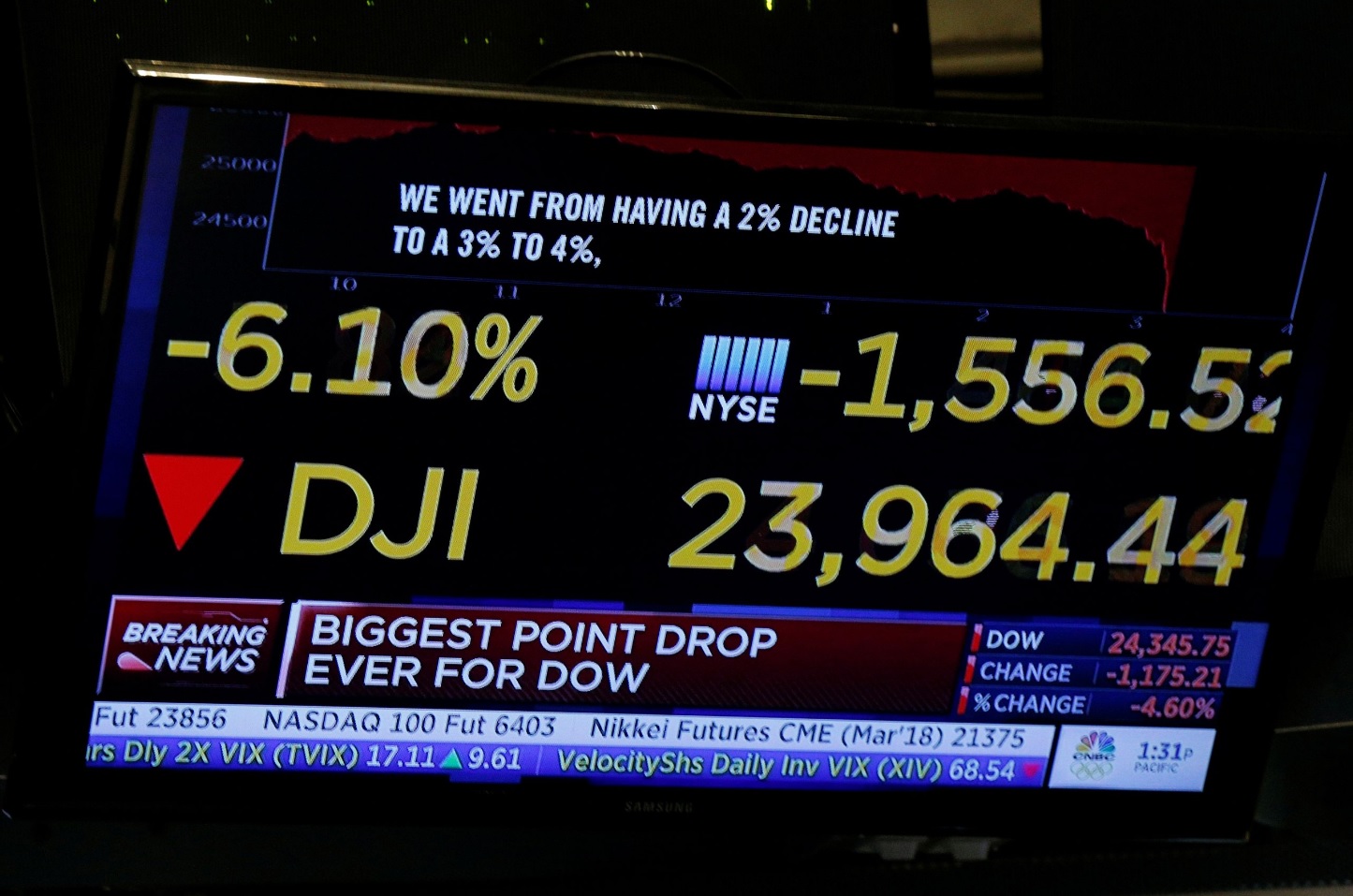

Stock Market Bounce 'Good for Gold Prices' as Yields Ease But Dollar Weighs

Wednesday, February 7, 2018 5:13:46 PM Europe/Tallinn

Gold prices rallied from yesterday's near 4-week low against the Dollar on Wednesday but held below $1330 per ounce as world stock markets failed to follow Wall Street's sharp bounce from the last week's 6% plunge.

Sources: Kitco, bullionvault.com